Well, It is not a super engineering work to import sales tax in your transactions when you use “SaasAnt Transactions” for QuickBooks. We will see how it can be done in this article.

For U.S QuickBooks Companies, you can mention Sales Tax in all your sales transactions like Invoice, Sales Receipt, Estimate &, etc. Kindly go through the below link to set up Sales Tax in QuickBooks Online.

http://www.teachucomp.com/set-up-sales-tax-in-quickbooks-online-tutorial/

How to record Sales Tax in QuickBooks:

To record Sales Tax for a transaction for QuickBooks online companies,

- We need to mark the Product or Service as taxable in the transaction.

- Sales Tax Code should be given in the transaction.

The above information is given to “SaasAnt Transactions” by mapping relevant fields from the file. In the next section, we will see how the fields are mapped to get Tax information.

Field Mapping in QuickBooks:

Please go through this link if you are new to the Field Mappings concept.

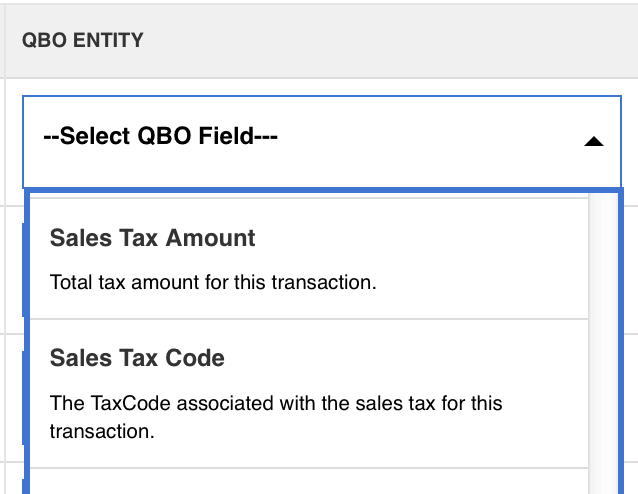

In the FIELD MAPPING SCREEN, for each Transaction Type (Invoice, Sales Receipt, Estimate & Credit Memo), you will get the following QuickBooks Fields.

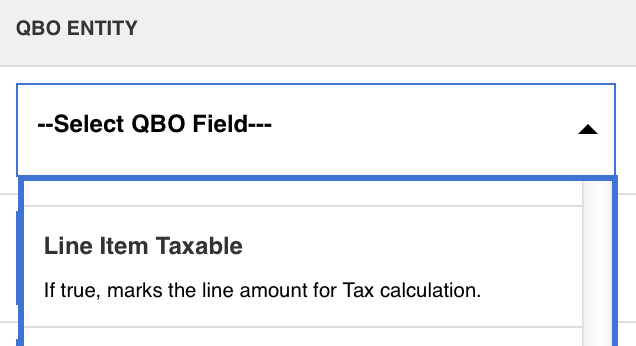

1.Line Item Taxable

2.Sales Tax Code

3.Sales Tax Amount (this is Optional)

1. Line Item Taxable:

This field takes only BOOLEAN value such as “TRUE” / “T” or “FALSE” / “F”.

If “Line Item Taxable” is TRUE, then the particular product or service will be counted for Sales Tax.

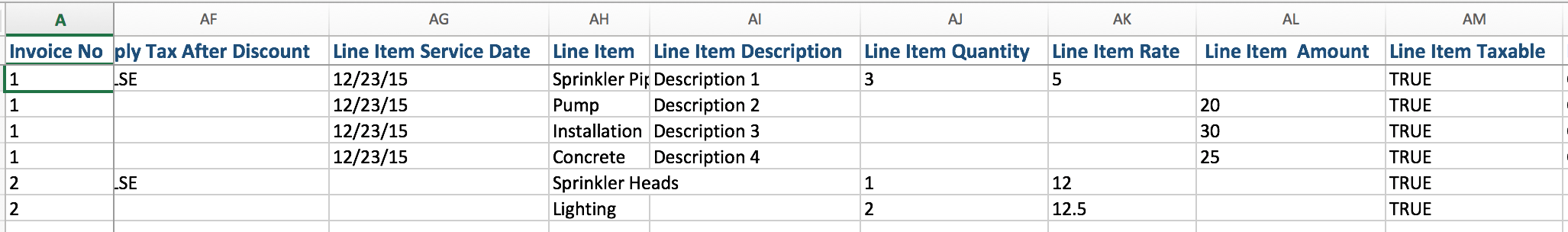

Field Mapping:

Sample File Template:

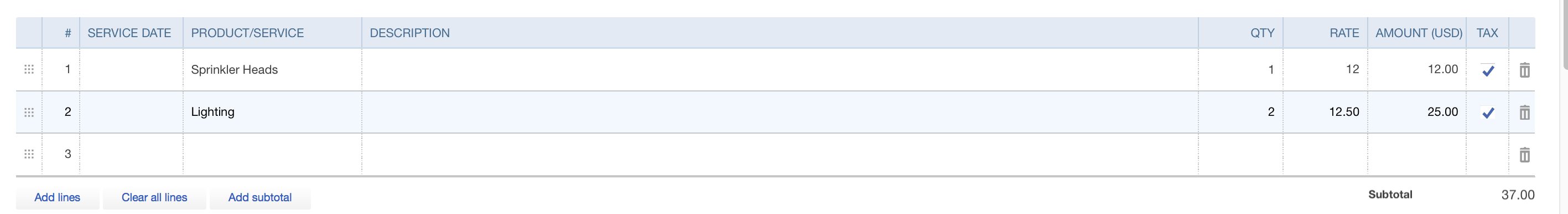

QuickBooks View:

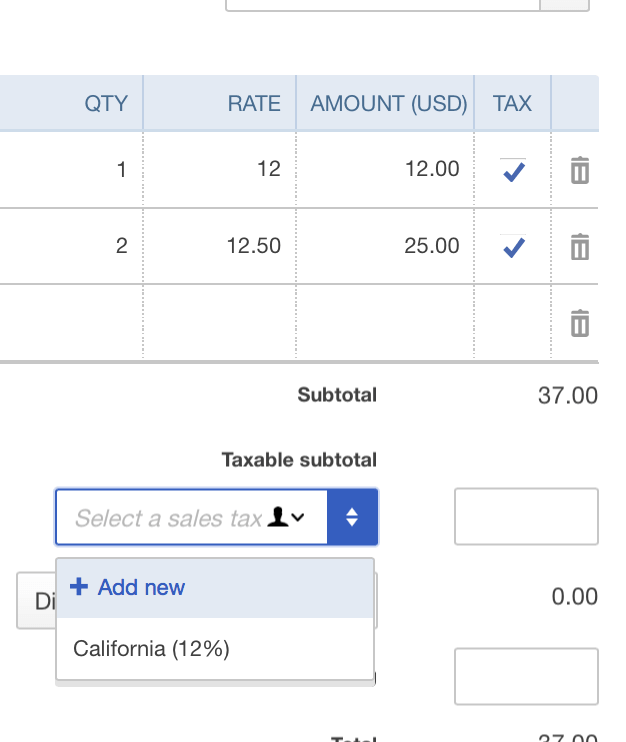

2. Sales Tax Code:

This field takes the PROPER Name of your Sales Tax. You can find the tax code name in QuickBooks UI ( Sales Tax menu). The Sales Tax Codes can be found by navigating to Sales Tax (left navigation bar) > Add/edit tax rates and agencies California, Tucson, AZ State tax and Tucson City are Sales Tax Codes in the below screenshot.

You can also refer to the sales tax code in Sale Transactions UI (QuickBooks). Check this Invoice Screen. The Sales Tax Code is “California” in the example.

Field Mapping:

3.Sales Tax Amount:

This is an optional field. Because “SaasAnt Transactions” will automatically calculate the tax based on Sales Tax Code and sends the final tax amount to QuickBooks Online.

As we want to control everything, we have provided an option to override the calculated amount. You can use this field to feed the actual tax amount.